Digital transformation is changing the insurance industry. It’s making things faster and more efficient.

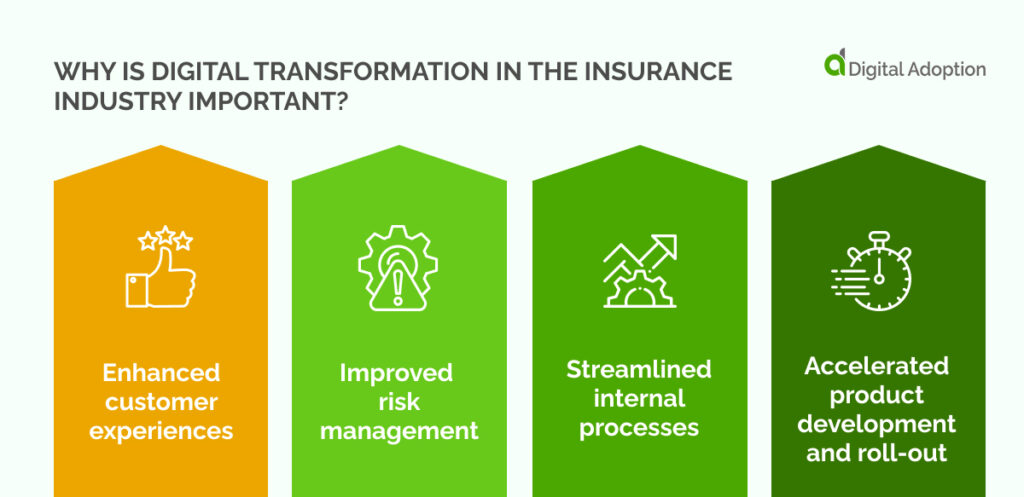

The insurance sector is evolving rapidly. Digital tools and technologies are now essential. They improve customer service, streamline operations, and enhance decision-making. Insurers are adopting artificial intelligence, big data, and blockchain. These technologies help in risk assessment, fraud detection, and personalized services.

Digital transformation also means better customer experiences. Policyholders can now access services online, anytime, and anywhere. This shift is not just about technology but also about culture and mindset. Companies must adapt to stay competitive. Embracing digital transformation is crucial for future success in the insurance industry. This blog will explore these changes and their impact on insurers and customers alike.

Credit: polestarsolutions.medium.com

Digital Trends In Insurance

Digital Transformation in the Insurance Industry is reshaping how companies operate. New technologies improve efficiency, customer experience, and data management. This shift helps insurers meet modern demands and stay competitive.

Ai And Machine Learning

AI and Machine Learning help insurance companies. These tools can analyze data quickly. They find patterns in customer behavior. This helps companies predict risks. They also improve customer service. Chatbots answer questions fast. AI helps in fraud detection too. It spots unusual activities and prevents fraud.

Blockchain Applications

Blockchain is useful for insurance. It keeps records secure. This technology makes transactions transparent. Policies and claims are easy to track. Blockchain reduces paperwork. It also speeds up claims processing. Trust between companies and customers grows with blockchain.

Credit: www.alldigitech.com

Customer Experience Enhancements

Personalized policies help customers feel valued. They match individual needs and preferences. This can lead to higher customer satisfaction. Using data, insurers can tailor coverage. This ensures each policy fits the customer perfectly. Personalized policies can also include flexible payment options. Customers appreciate this convenience.

A seamless claims process is crucial. It reduces stress for customers. Digital tools speed up claims handling. Customers can submit claims online. This saves time and effort. Automated systems can process claims quickly. This leads to faster payouts. A simple and quick process builds trust. Customers feel secure knowing their claims are handled efficiently.

Operational Efficiency

Automation helps save time. Many tasks are repetitive. Computers can handle these. This reduces human errors. Employees can focus on complex jobs. This improves service quality. Automation also speeds up processes. Faster services make customers happy.

Data analytics helps understand patterns. It shows customer needs. Insurers can offer better products. Risks can be assessed more accurately. This leads to fewer losses. Data helps in making smart decisions. It also helps in fraud detection. This protects the company and the customers.

Credit: www.digital-adoption.com

Risk Management Advancements

Predictive analytics helps in understanding future risks. It uses data to predict claims. This helps in setting fair premiums. Companies can avoid big losses. It uses customer history. It also looks at market trends. These tools help in making smart decisions. Predictive analytics is a key tool today.

Cybersecurity is very important. Sensitive data needs protection. Insurance companies use firewalls and encryption. These keep information safe. Regular security checks are done. Employees get training to spot threats. Strong passwords are a must. Companies also use multi-factor authentication. This adds an extra layer of security.

Future Of Digital Insurance

Digital insurance is changing fast. New products are made every day. These products use AI and big data. They help predict risks better. Many companies now offer customized plans. These plans fit each person’s needs. They can be changed online. No need for long calls or meetings. This saves time. It is also more convenient for customers.

Regulations can be tough for digital insurance. Different countries have different rules. Companies must follow these rules. This can slow down progress. Some regulations are old and do not fit new technology. Governments need to update laws. This will help the industry grow. Until then, companies must be careful. They need to balance innovation and compliance.

Frequently Asked Questions

What Is Digital Transformation In Insurance?

Digital transformation in insurance means using technology to improve services and operations. It makes processes faster and more efficient.

How Does Digital Transformation Benefit Insurance Companies?

It reduces costs, improves customer experience, and increases efficiency. Companies can offer better, faster, and more personalized services.

What Technologies Are Used In Insurance Digital Transformation?

Common technologies include AI, big data, cloud computing, and IoT. They help in data analysis, automation, and customer service.

What Are The Challenges In Digital Transformation For Insurance?

Challenges include data security, high costs, and resistance to change. Adapting to new technologies can be difficult.

How Does Digital Transformation Impact Customers?

Customers get faster services, personalized policies, and better claims processing. It improves overall customer satisfaction.

Conclusion

Digital transformation reshapes the insurance industry. It enhances efficiency and customer service. Insurers can now provide personalized experiences. Automation reduces costs and errors. Embracing digital tools is crucial for staying competitive. The future of insurance looks promising with these changes.

Stay updated and adapt to succeed.

Sufiya Begom is a Passionate Digital Innovator and the Visionary Founder of the Dynamic Platform, Digital Pro Info. With a deep-rooted enthusiasm for digital technologies, Sufiya has built a comprehensive space that offers valuable insights into digital products, reviews, guides, software, and sales, empowering individuals to make informed decisions in the ever-evolving digital landscape.